installment open end credit example

C automobile loan from a credit union. An example of an installment loan would be a car loan you are required to pay a set amount of money at a recurring interval ex.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

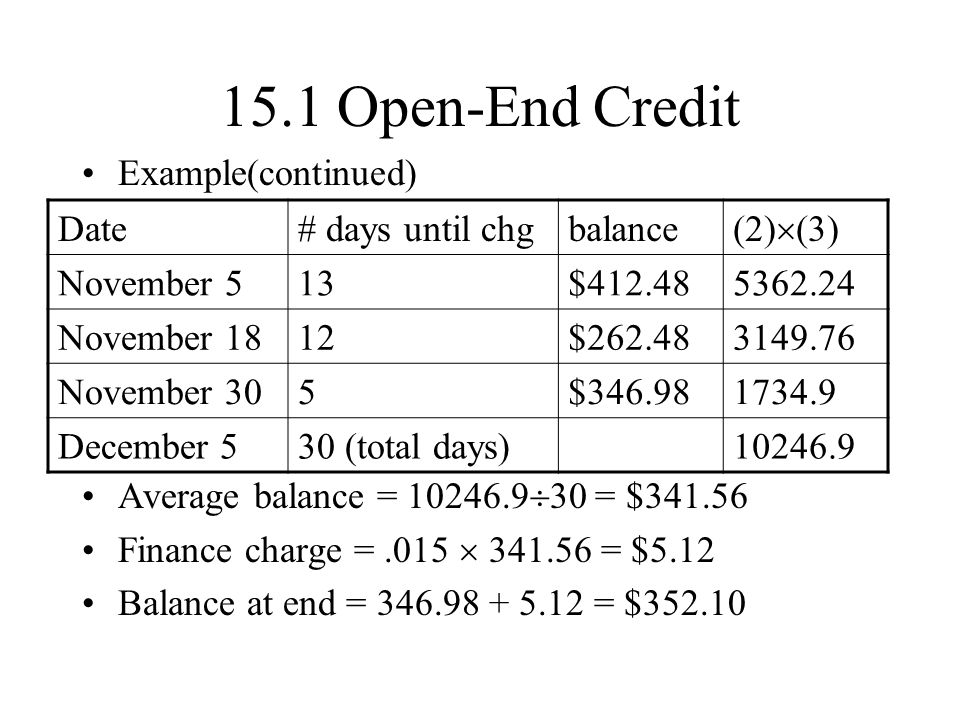

The first payment amount is labeled as an estimate since the transaction date is uncertain.

. What is an example of installment credit. In the consumer market home equity loans are an example of an open-end credit which allows homeowners to access funds based on the level of equity in the homes. With some forms of open-end credit theres no end date.

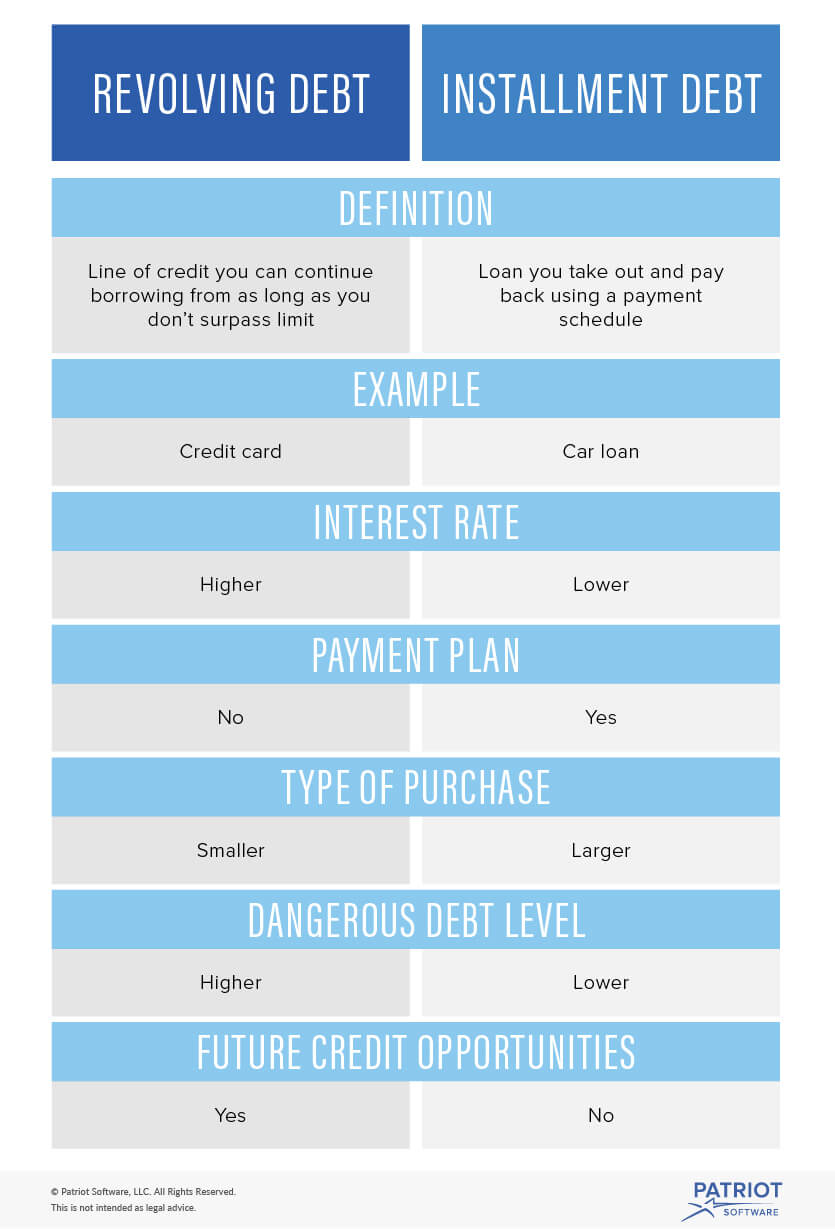

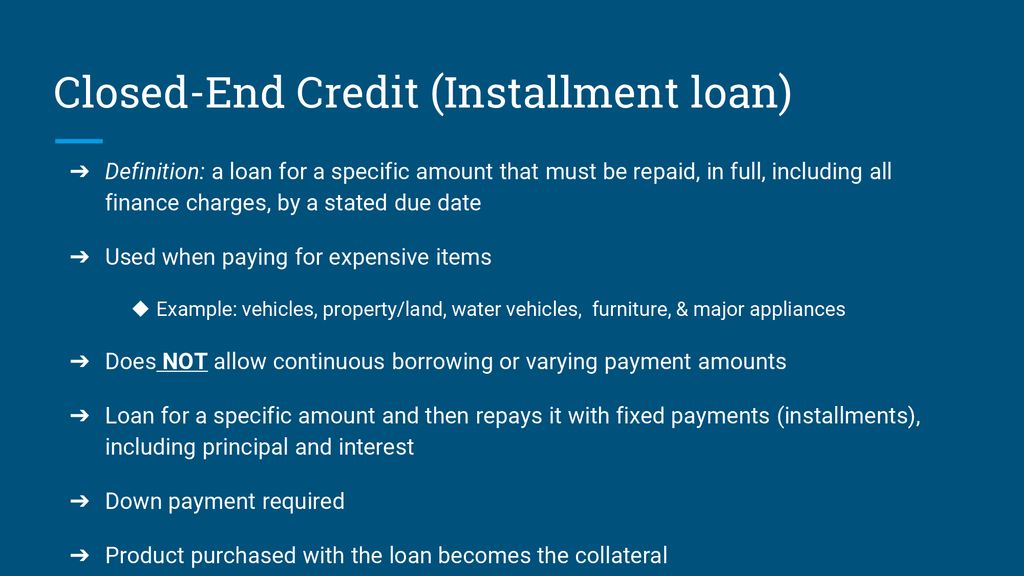

Rate caps are often structured based on tiers of credit. Installment loan for purchasing a major appliance. But closed end credit is for a stipulated time with a specific interest rate and charges.

The _________________ for a credit cards billing period is the sum of the unpaid balances from each day in the billing period divided by the number of days in the billing period. Common examples of revolving-open end. Depending on the product you use you might be able to access the funds via check card or electronic transfer.

Credit card accounts home equity lines of credit HELOC and debit cards are all common examples of open-end credit though some like the HELOC have finite payback periods. Which of the following is an example of open-end credit. 280 per month until the loan is paid off in full.

Open end loan can be borrowed multiple times. Home mortgages car loans and student loans are the most common examples of installment credit. For a 2000 closed-end installment loan.

When you purchase an item your available credit decreases. Click to see full answer. An example of conventiona.

Common examples of open-end credit are credit cards and lines of credit. Common examples of installment accounts include mortgage loans home equity loans and car loans. As you make the payments the balance of the account lowers.

Summary An open credit is a financial arrangement between a lender and a borrower that allows the latter to access credit repeatedly up to a specific maximum limit. Home mortgages car loans and student loans are the most common examples of installment credit. CREDIT TYPE 1.

Model clause a is for use in connection with credit card accounts under an open-end not home-secured consumer credit plan. When you make payments youll be able to reuse the same credit. The issuing bank.

A good example of an open-end credit is. View the full answer. A student loan is also an example of an installment account.

A Single lump sum of credit B An installment loan for purchasing furniture C A mortgage loan D A department store credit card E An automobile loan. For example Iowas Regulated Loan Act caps interest at 36 on the first 1000 24 on the next 1800 and 18 on the remainder. Sample G-24 includes two model clauses for use in complying with 102616h4.

Open-end credit refers to any type of loan where you can make repeated withdrawals and repayments. Many financial institutions refer to closed-end credit as an installment loan or a secured. Other examples include mortgages Mortgage A mortgage.

Examples of installment loans include mortgages auto loans student loans and personal loans. Using a credit card is an example of an _____________ installment loan for which there is no schedule for paying a fixed amount each period. Installment credit is when you borrow a specific amount of money from a lender and agree to pay off the loan in regular payments of a fixed amount over a specified time period.

This sample illustrates an installment loan. A typical car loan checks all of the boxes of. See interpretation of this section in Supplement I.

Automobile loan from a credit union. Installment loan from a furniture store. An example of open-end credit is mortgage loans as there are specific open end mortgage loans available so correct option will be C mortgage loans Automobile loans and revolving check credit are closed ended loans.

The amount of the loan is 5000. Examples include credit cards home equity loans personal lines of credit and overdraft protection on checking accounts. As you repay what youve borrowed you can draw from the credit line again and again.

The use of a bank credit card to make a purchase. The resulting APR which blends these rates is 31 on a 2000 loan. There is a 12 simple interest rate and a term of 2 years.

Model clause b is for use in connection with other open-end credit plans. The date of the transaction is expected to be April 15 1981 with the first payment due on June 1 1981. A mortgage loan from a savings and loan institution.

What Are Three Types Of Consumer Credit

13 1 Compound Interest Simple Interest Interest Is Paid Only On The Principal Compound Interest Interest Is Paid On Both Principal And Interest Compounded Ppt Video Online Download

Akulaku Shop On Installment Apps On Google Play

Revolving Debt Vs Installment Debt What S The Difference

How To Read Your Credit Card Statement Rbc Royal Bank

Lesson 16 2 Types Sources Of Credit Ppt Download

What Are Three Types Of Consumer Credit

What Is Open End Credit Experian

What Is Non Installment Credit Lisbdnet Com

Chapter Open Ended Credit An Agreement To Lend The Borrower An Amount Up To A Stated Limit And To Allow Borrowing Up To That Limit Again Whenever Ppt Download

5 Benefits Of Open Banking For Consumers Belvo

Lesson 16 2 Types Sources Of Credit Ppt Download

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

Understanding Different Types Of Credit Nextadvisor With Time

Line Of Credit Vs Installment Loan Moneykey

What Is Non Installment Credit Lisbdnet Com

Consumer Credit Regulation Nclc Digital Library